Updating the “Magazine Cover” Indicator

Rocky occasionally peruses his favorite magazine store for investment truths using the “Magazine Cover Contrary Indicator.” Unfortunately, Rocky’s local store doesn’t sell Time, Newsweek or Business Week. Rocky’s local magazine store sells mostly lurid “periodicals,” “videos,” and cigars.

Hence, Rocky needed to develop his own contrary media indicator — independent of bulls, bears, and cleavage.

He found one!!

Bloomberg Radio occasionally adjusts their hourly market summaries. Bloomberg no longer even mentions the overnight change in the Japanese Stock Market (up 15% year-to-date); but instead they quote the “yield spread” on defaulted Greek Bonds. For Rocky, this is a very bullish omen for Japanese stocks. And it also means that Greece is irrelevant. (Rocky also noticed his local magazine store has increased its inventory of extremely lurid Shukanshi.)

[Disclosure: Rocky NEVER gives investment advice and he reminds readers that sometimes a “Cigar is just a cigar.” However, he confesses that this “radio indicator” contributed to his decision to recently buy some Japanese stocks (currency-hedged) such as the DXJ and NKY Japanese Stock ETF’s. He may stay with this position for a long time, or he may spit it out tomorrow like a bad cigar.]

Guess this object and win!

Rocky’s been busy lifting large boulders, and then seeking medical assistance for the consequences of lifting large boulders. He apologizes for his recent blog silence, and offers another “Guess this object” contest as a goodwill gesture to his loyal readers. As always, the reader who correctly guesses the object will receive a unique prize of dubious monetary value.

Hint: The dimensions are 30cm x 30cm x 30cm. The yellow material is chamois (genuine). Inside of the object is a flashlight and a Poland Spring water bottle filled with 50% anti-freeze (Prestone) and 50% water. A piece of asphalt shingle is on the top of the object. And the stripes are “designer” duct tape.

[Disclosure: Rocky rarely uses duct tape with designer colors. As Trophy Wife will attest, he’s strictly a grey-sort-of-guy.]

Investment advice for Ron Paul

Rocky never provides investment advice. But for once he’ll violate this rule and offer some advice to Congressman Ron Paul.

Members of Congress must file financial disclosure forms which show all of their assets and investments. Rocky studied Rep. Paul’s portfolio from 2003 to the present. http://www.legistorm.com/memberdisclosure/413/Rep_Ron_Paul_TX.html

Ron Paul’s portfolio violates every principle of sound money management. It is not prudent. It is not sensible. It is volatile. It is speculative. And it may give a window into Ron Paul’s perspective on the economy and free enterprise.

From 2003 to the present, Ron Paul’s stock portfolio owned only gold stocks. He owned some real estate. He had some cash. And he owned mutual funds that make money ONLY WHEN the stock market declines. He did not own any gold bullion. And more recently, he purchased more gold mining stocks and added to his bearish bets on the stock market using leveraged bearish funds.

In 2003, the value of his portfolio was between $860,000 and $2,300,00. (The disclosure form only provides a range of values.) In 2010, his portfolio grew to $2.4 million and $5.5 million. (Gold stocks have declined between 15% and 30% in 2011, so his portfolio has declined commensurately. He will declare that loss next year.)

So, over an an 8-year period his portfolio has appreciated by about 12%/year. (And after this year’s losses for gold mining stocks, it will be a bit less than that.)

Not so bad, eh?

Nope!

If, instead of being such a wiseguy, he had instead just purchased gold bullion, his return would have been 55% better — returning an impressive 18.5% per year! (It’s very strange that Ron Paul doesn’t own any bullion. And a skeptic might wonder whether he owns bullion, but failed to disclose it.)

[Disclosure: If one extrapolates the profile of his portfolio, one must conclude that he either nailed the bottom of the gold market, or he has really lousy long term performance. Remember that (even after this 10 year old rally) gold has appreciated at only about 5% for the past 30 years, while stocks have returned about 11%, and long bonds have returned high single digits. More troubling, however, is the notion that a President of the United States would personally profit from a DECLINING stock market and a declining economy! Even Barack Obama’s assets include some S&P Index Funds….]

Why Groupon resembles a ‘roach motel’

The term Roach Motel (“where roaches check in, but they don’t check out!”) was coined by Black Flag pesticides in a decades-old advertisement. Judging from Rocky’s recent experience, Groupon membership is quite similar.

The hair-raising secret for achieving higher SAT test scores

If you’re about to spend $2,000 on a Kaplan SAT prep class, save your money. Rocky shares an untold, hair-raising secret which will improve one’s SAT score for only $4.99.

Last weekend, Rocky drove his youngest daughter to her SAT test. The crazed, competitive, collegiate- co-ed-to-be carried the consummate commodities: pencils, calculator, wristwatch, ID card. She also carried the non-essentials: banana, bag of veggie chips. bottle of water. Additionally, she brazenly brought the backup bag: a dozen spare pencils, spare batteries…

The duo set out on the drive to the test site when Daughter suddenly screamed: “Stop the car. I need to go back home!”

Was this a case of sudden-onset diarrhea? Or perhaps a life-changing revelation that she wanted to skip college and launch the next Apple Computer Company?

Neither.

“Dad – I need a spare Scunci for my hair,” she said.

(Scuncis are those elastic bands that hold long hair in a properly coiffed manner. As Rocky is bald, he views them as useful only as sling shots and holding car tailpipes in place when the rubber hanger fails.)

“You’ve GOT to be kidding,” said Rocky, thinking that Trophy Wife’s frequent caveats about Bad Hair Days had finally hit home. (Rocky failed to imagine the dire consequences of a Scunci that goes “snap” — somewhere between reading comprehension and vocabulary. Would Daughter suddenly be blinded by her ample golden locks? Might Rocky suffer legal liability if an out-of-control Scunci went sailing across the room and injured a fellow test-taker?”)

Grumbling about “women,” he drove back home and waited patiently (listening to NPR’s Car Talk), while Daughter ran inside to get a spare Scunci.

Later that day, Rocky asked Daughter about the test, and he also asked which was more useful: the banana or the spare Scunci…

“It’s really good that I had a spare Scunci,” Daughter said. The desks were incredibly tiny and my pencils kept rolling off them and falling on the floor. I used the spare Scunci to tie my spare pencils together and it surely boosted my score by at least 100 points!”

[Disclosure: Indiviudal results may vary. Unlike the Kaplan Prep Class, the Scunci Company doesn’t offer refunds if SAT scores fail to improve.]

What to do with an old computer?

An old Dell computer has sat in the corner of Rocky’s home library for months. Rocky promised Trophy Wife that this unsightly dust magnet would eventually “disappear,” yet even Rocky’s trusted Computer Guru won’t carry the box away. The Computer Guru explained that no charity would want such a relic.

What to do? Rocky lists some possible uses for the “low profile” desktop computer:

1. It weighs about 15 pounds. Perhaps it can be used as a “medicine ball” … to be tossed back-and-forth in the gym?

2. In lieu of bricks, it could be placed in the trunk of a car…providing added traction for winter driving.

3. It can be donated to Habitat For Humanity and used as a substitute concrete block for new construction.

4. It can serve as a step stool to reach the top shelf in the pantry.

5. It can be used as a space heater to warm up the bathroom floor on cold mornings.

6. It can serve as a standing platform for meditation and yoga. Alternatively, smashed with a sledge hammer, it can provide a more effective release for life’s frustrations.

7. It could be buried in the backyard as a time capsule for future generations to find.

The Best of Beethoven

At dinner this evening, Rocky’s daughter reminded her father that he’s been promising to buy her a CD with all nine Beethoven symphonies — for months. Rocky’s a terrible procrastinator. Especially when it comes to spending money.

Admittedly, some kids want iPads. And some kids want new cars. And other kids want a shopping trip to Abercombrie & Fitch. Rocky’s daughter wants the complete symphonic works of Beethoven, which is both financially much less demanding and slightly amusing.

But — it’s not so simple. There are actually more Beethoven recordings than Baskin & Robbins’ ice cream flavors…

There’s Von Karajan — with his iconic 1963 recording with the Berlin Philharmonic (digitally remastered so only one’s hair dresser knows for sure that it’s actually analog. )

And there’s Leonard Bernstein. With his “idiosyncratic” 1960’s recording with the New York Philharmonic.

And there’s John Eliot Gardiner with a 2010 recording by the Orchestre Revoltionnaire et Romantique. (but that sounds FRENCH. Ugh!)

And the list goes on and on and on and on….Amazon has dozens of choices … Philadelphia Orchestra, Cleveland Orchestra, San Francisco Symphony, London Symphony, etc etc etc.

[Disclosure: Rocky picked the Von Karajan Deutsche Grammaphon recording, and purchased it from a vendor who undercut Amazon’s price! P.S. Rocky’s daughter has no relation to Linus.]

How to prepare for financial armageddon? (Bring your own socks)

In light of the ongoing European financial crisis, Rocky is pleased to learn that the European Central Bank now provides visitors to their headquarters with a “hard hat” at no cost! However, they do ask visitors to “wear socks.”

No mention is made whether visitors must empty their pockets of spare change upon entering.

For a full text of the ECB’s dress code, see “What to wear” at:

http://www.ecb.int/ecb/visits/how/nep/html/index.en.html

Rocky’s (latest) view on gold

Knowing that he’s been a gold bull for years, Rocky’s friends keep asking: “What you do think of gold, NOW?” (These people actually think that Rocky and certain other TV commentators can predict the future.)

Rocky’s answer: “I have no idea, and have NEVER had any idea about what the price of gold will do tomorrow.”

But does he still own gold?

“Yes, and I also own some stocks. And I own some real estate. And I own some bonds. And I own a copy of last week’s People Magazine. And I have no idea what the price of these will do tomorrow either. My experience has been that pundits who claim perfect knowledge of the future are generally either liars or idiots. (Whoopi Goldberg is the exception to this rule.) What I’m doing is called diversification.”

But when will he sell gold?

“The PRICE of gold is irrelevant. As I’ve written on this blog, I will sell gold when the gold story (or more accurately, the market’s perception of the gold story) changes! Gold’s ascent is a confluence of negative real interest rates; undisciplined central bank behavior; a growing loss of confidence in government policies and financial systems; loss of Swiss bank secrecy; an accumulation of economic wealth by individuals in parts of the world without stable property rights and rule of law. Can gold drop $100 tomorrow? Sure it can! Can gold drop $300 next week? Sure it can! Can gold drop $1000 next year? Sure it can! But so long as these FUNDAMENTAL factors remain in place, the underpinnings and demand for hard assets that are beyond the reach of governments will remain.”

“Almost all of my really smart friends are very bearish right now. They all think this move is idiotic. Many think this is a bubble. And eventually they will be right. But eventually could be a really really long time. And it could include a trip to unimaginably higher prices first. Their skepticism is not predictive of anything. And importantly, they are not betting that gold will decline either. All it tells you is that they aren’t long gold and missed this move. I’ll admit that I get nervous when prices rise quickly. And historically, buying after a sharp rally isn’t a good idea. But why should any of this market chatter affect my long-term porfolio construction/diversification? After all, I’m not afraid to admit that I have absolutely no idea what prices will do tomorrow.”

[Disclosure: Rocky NEVER gives investment advice. He’s owned gold for a long time. And he owns some hedges that will protect him if gold drops sharply while he’s asleep. And some day, he will sell his gold. But whether it’s at $2,000/oz or $10,000/oz is out of his control. It’s in the control of millions of other investors around the world, and how they react to the policies of their central banks and governments.]

Making one head(s) spin: the US credit rating

Rocky penned the following brain-teaser for the pages of an august publication — and wants to share it with his loyal readers…as it highlights an important market foible:

“I’m sure that we’ve both noticed that whenever Moody’s or S&P release a bearish

press release about the sovereign AAA rating, the stock market gets whacked by

1+%, but the US bond market hardly moves (or even rallies). One can explain the

downward move in stocks by observing that “in times of uncertainty, people

reduce their risk and seek the safety of riskless investments.” But is this

rational? Here, the increased uncertainty is arising from the RISKLESS asset.

So, if the riskless asset is becoming more risky, must it follow that the risky

assets are proportionately more risky? That is, if you sell the risky asset

because you’re scared of the riskless asset, does it follow that you should buy

more of the riskless asset even though it’s becoming more risky, and that’s

what made you sell the risky asset to begin with?

[Disclosure: Rocky expects that if Congress raises the debt limit without substantial spending cuts, bond yields will rise sharply….]

Danger: wild animal prowls hedge fund capital

“Cougars” routinely prowl the bars of Greenwich, Connecticut, a town with more hedge funds per capita than any other US city. However, Rocky suspects some cougars have mutated into mountain lions — which pose a far greater threat:

From the Connecticut State Department of Environmental Protection:

The Connecticut Department of Environmental Protection (DEP) today announced it is cooperating with the Town of Greenwich Police Department to investigate recent sightings of a large cat in the King Street area of Greenwich. Based on photographs taken of the animal and other evidence it appears that the animal is a mountain lion that has been held in captivity and was released or escaped. There is no native population of mountain lions in Connecticut and the eastern mountain lion has been declared extinct by the U.S. Fish and Wildlife Service. Anyone that sees this animal should not approach it and immediately call the local police and the DEP 24-hour Emergency Phone Line at 860-423-3333.

The full press release can be found here: http://www.ct.gov/dep/cwp/view.asp?Q=480832&A=4013

[Disclosure: Trophy Wife brought this development to Rocky’s attention. She assured Rocky that if she sees the mountain lion, she won’t offer the animal any leftover Frappachino from the Greenwich Starbucks.]

Trivia triggers technology titillation

After Rocky finishes reading the National Enquirer, he turns to the Guinness Book of World Records to find investment themes.

Question: What technology company and product holds the Guinness World Record of being the “fastest selling consumer electronics device ever?” [Hint: it happened in the past 12 months.]

Answer: Click here for the answer.

[Disclosure: Rocky never provides investment advice, but he admits that he has started purchasing shares of the company that manufactures the Fastest Selling Cosumer Electronics Device EVER! ]

David Hasselhoff, Baywatch & California finances

A recent article in the Orange County Register reminded Rocky of the glory days from Baywatch , (the most-watched TV show of all time.)

The newspaper article explained that being a REAL lifeguard may be a better gig than being a TV lifeguard!

From the newspaper story: “According to a city report on lifeguard pay for the calendar year 2010, of the 14 full-time lifeguards, 13 collected more than $120,000 in total compensation; one lifeguard collected $98,160.65. More than half the lifeguards collected more than $150,000 for 2010 with the two highest-paid collecting $211,451 and $203,481 in total compensation respectively. Even excluding benefits like health care and pension, more than half the lifeguards receive a total salary, including overtime pay, exceeding $100,000. And they also receive an annual allowance of $400 for “Sun Protection.” Many work four days a week, 10 hours a day.

The article continues: “On face, the compensation packages for these guards are staggering. But take into consideration the retirement benefits being paid to currently retired lifeguards and lifeguards who will retire at these pay levels in the future and the problem is further compounded. Lifeguards are able to retire with 90 percent of their salary, after only 30 years of work at as early as the age of 50.”

The entire story can be found here: http://orangepunch.ocregister.com/2011/05/10/lifeguarding-in-oc-is-totally-lucrative-some-make-over-200k/44783/

[Disclosure: Although Orange County generously provides a $400 “sun protection” allowance, Rocky notes that they do not yet provide a plastic surgery allowance. Pamela Anderson wannabes should take note…]

New terror threat: snowglobes

Trophy Wife snapped this photo at a major NY airport, and then emailed it to Rocky. No word whether her Blackberry was seized during the ensuing pat-down search.

It’s good to see that the TSA has adopted the international “No Snow Globe” symbol.

[Disclosure: Rocky always carries a Pez Floaty Pen — which is effective at filling out Government Forms, and earns compliments at serious Corporate Board Meetings. Rocky fears that the TSA ban on Snowglobes may spread to Floaty Pens. If that happens, he’ll switch to a Crayola Crayon. ]

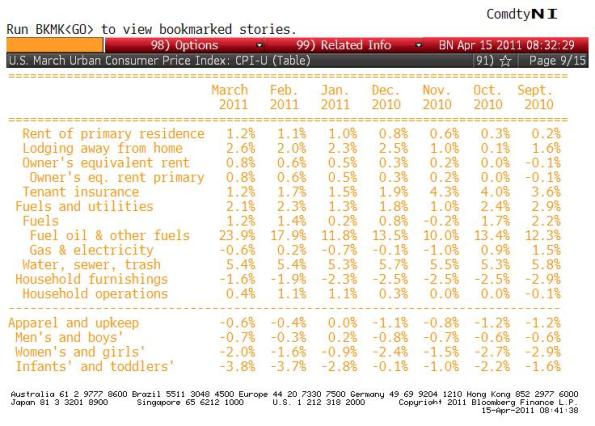

CPI shows women & children first?

The Captain of the Titanic supposedly said, “Women and children first!” when directing his passengers to the lifeboats.

Rocky, (hardly a chivalrous fellow), thinks recent Consumer Price Index data demonstrate “Women and Children LAST!”

He notes that women’s and children’s apparel prices are declining at a noticeably faster rate than men’s apparel prices. (See the bottom three lines of the chart above.) Although Rocky continues to wear the same ragged grey sweater and chinos, Trophy Wife may find this data to be an impetus for a visit to the shopping mall.

Rocky theorizes that women can wear men’s clothes (which support the price of shirts and pants), whereas most men wouldn’t be caught dead wearing a dress or skirt. However, if this trend continues, Rocky’s miserly nature will prevail, and he’ll try on a kilt or two.

Calculator batteries & tax returns

IRS data show an epidemic of “math errors” on personal income tax returns.

During calendar year 2007 the IRS counted “only” 3,885,505 mistakes. Yet in calendar year 2010, they counted 10,554,735. That’s a shocking 272% increase in arithmetic mistakes. The full IRS data set can be found here: http://www.irs.gov/taxstats/article/0,,id=207345,00.html

The IRS says math errors “include a variety of conditions such as computational errors, incorrectly transcribed values, and omitted entries identified during the processing of returns.”

Rocky wonders whether the epidemic of errors is due to the widely reported declining math skills of Americans. (“One-quarter of students at undergraduate and graduate levels believe that 1 divided by 5 = 5.”) Or perhaps it’s due to the increasing use of Turbotax (thanks to Treasury Secretary Geithner.)

[Disclosure: Rocky always changes his calculator batteries before starting his tax return, and highly recommends this practice for other law-abiding citizens. The IRS data did not disclose how many of the math mistakes identified were in favor of the government!]

Japanese stocks yield more than US stocks

For the first time in decades, the dividend yield of Japanese stocks exceed the dividend yield of US stocks. As of the close on March 15th, the S&P-500 dividend yield is 1.86. After last night’s 10% decline in Japan (and the horrific catastrophe unfolding there), the dividend yield on the Nikkei-225 is now 2.02%. (The chart above shows the S&P-500 dividend yield minus the Nikkei-225 dividend yield using monthly data. It doesn’t include the post-earthquake price moves.)

Determining whether this represents an investment opportunity, or an accurate reflection of the long-term prospects for Japanese industry, is left as an exercise for the reader. Rocky notes that Japanese 10 year bonds yield 1.21% and US 10 year bonds yield 3.24% — which makes this dividend phenomenon even more striking.

[Disclosure: Rocky never provides investment advice. He will also forgo any jokes about the dismissal of the Aflac Duck because it would be inappropriate — as the Japanese people suffer the aftermath of a historic disaster. ]